Introduction

The price of Bitcoin has become a focal point for both investors and the financial market, reflecting shifts in investor sentiment and economic conditions. Its price movements are closely monitored as they can indicate broader trends in the cryptocurrency market and affect the value of other digital assets. As of late 2023, Bitcoin’s price has once again entered discussions regarding its potential impact on the global economy.

Current Trends in Bitcoin Pricing

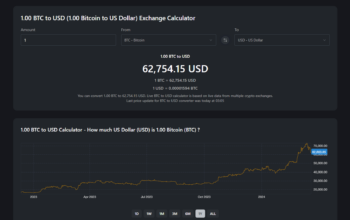

At the beginning of November 2023, Bitcoin was trading at approximately £31,000, marking a significant increase from its lows earlier in the year. This surge is attributed to renewed interest from institutional investors and the ongoing adoption of cryptocurrencies in mainstream finance. Major financial institutions have started to incorporate Bitcoin into their portfolios, seeing it as a hedge against inflation and a store of value akin to gold.

The Bitcoin market has seen substantial volatility, with prices swinging wildly in response to regulatory news, macroeconomic trends, and changes in investor behaviour. For instance, when the US Federal Reserve signalled potential interest rate hikes, Bitcoin initially witnessed a dip, only to bounce back shortly thereafter as investors realised its long-term value potential.

Factors Influencing Bitcoin Price

Several key factors are currently influencing Bitcoin’s price:

- Regulatory Environment: Changes in regulations across major economies can have immediate effects on Bitcoin’s price. In recent months, there has been a global push towards regulating cryptocurrencies, which some investors see as a positive development for legitimacy.

- Market Sentiment: Social media trends and influential endorsers can rapidly shift public perception. The impact of endorsements or criticisms from notable figures can lead to dramatic price fluctuations.

- Technological Developments: Innovations within the Bitcoin network, including scaling solutions and security upgrades, can influence its attractiveness as an investment.

- Global Economic Climate: Uncertainties in global markets, driven by inflation rates, geopolitical tensions, and energy prices, often lead investors to consider cryptocurrencies as alternative assets.

Conclusion

The ongoing dynamics surrounding Bitcoin’s price make it crucial for potential investors to stay informed about market trends and economic indicators. While the cryptocurrency has proven to be resilient, its volatility remains a point of concern for risk-averse investors.

Looking ahead, analysts suggest that Bitcoin could face further challenges but also opportunities for growth as regulatory frameworks become clearer and adoption rates rise. For those considering entering the Bitcoin market, awareness of these factors will be essential for making informed investment decisions.