Introduction

Bitcoin, the world’s first decentralised digital currency, has gained significant traction over the past decade. Launched in 2009 by an anonymous entity known as Satoshi Nakamoto, Bitcoin represents a revolutionary approach to monetary transactions, eliminating the need for central banks and intermediaries. As cryptocurrency continues to penetrate mainstream finance, understanding its implications, developments, and future relevance becomes increasingly essential.

Recent Developments

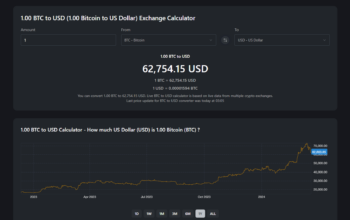

The Bitcoin market has experienced substantial volatility in 2023, with its price fluctuating between £20,000 and £30,000. Recently, the digital asset surged past the £28,000 mark due to increased institutional adoption and the potential for the approval of Bitcoin exchange-traded funds (ETFs) by regulatory authorities, specifically in the United States. In July, BlackRock, one of the world’s largest asset management firms, submitted an application for a Bitcoin ETF, stirring optimism amongst investors and fostering discussions regarding Bitcoin’s legitimacy as a financial asset.

Moreover, several countries have begun to embrace Bitcoin and other cryptocurrencies, recognising their potential impact on modern financial systems. Countries like El Salvador have officially adopted Bitcoin as legal tender, while other nations explore regulatory frameworks to facilitate crypto innovation while ensuring consumer protection.

Challenges and Concerns

Despite its growing popularity, Bitcoin faces significant challenges. The environmental impact of Bitcoin mining has come under scrutiny, with critics highlighting the substantial energy consumption required for transaction verification and mining activities. Additionally, regulatory uncertainty continues to pose risks for Bitcoin’s adoption, as governments worldwide establish frameworks to govern crypto transactions and combat fraudulent activities.

Future Perspectives

Looking ahead, experts suggest that Bitcoin’s trajectory will likely involve increased acceptance among mainstream investors and businesses. As companies continue to diversify their portfolios with digital assets, the potential for Bitcoin to function as a hedge against inflation remains a topic of significant interest. However, investors must remain cautious, as the cryptocurrency market is notorious for its rapid price fluctuations.

Conclusion

Bitcoin continues to be at the forefront of discussions surrounding the future of money and finance. As digital currencies gain prominence and evolve, understanding Bitcoin’s potential benefits and risks will be crucial for individuals and institutions. Ultimately, its path forward is intertwined with global regulatory developments, technological advancements, and economic trends, making it a vital subject for anyone interested in finance and digital currencies.