The Importance of Cryptocurrency Trading

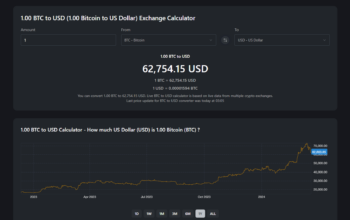

Cryptocurrency trading has surged in popularity over the past decade, allowing investors to engage in the fast-evolving digital asset market. With a market cap exceeding $1 trillion, cryptocurrencies like Bitcoin and Ethereum have not only reshaped the financial landscape but have also influenced traditional trading practices. As more individuals and institutions enter the market, understanding the fundamentals of cryptocurrency trading becomes crucial.

Current Trends and Developments

As of late 2023, several key trends have emerged in the realm of cryptocurrency trading. Firstly, increased regulatory scrutiny is shaping how exchanges operate worldwide. Following significant price fluctuations and fraud incidents, governments have begun to implement stricter regulations, aiming to protect consumers and stabilize the market. Major economies, including the United States and the European Union, are in the process of finalising frameworks for the cryptocurrency sector.

Secondly, the rise of decentralized finance (DeFi) platforms has revolutionised trading strategies. These platforms allow users to trade cryptocurrencies without the need for intermediaries, offering greater control and flexibility. DeFi has seen rapid growth, with total value locked in DeFi protocols surpassing $80 billion, reflecting strong market adoption.

Technological Advancements

Technological advancements also play a significant role in cryptocurrency trading. The integration of artificial intelligence (AI) and machine learning algorithms enables traders to analyse vast amounts of data, helping to inform trading strategies and improve decision-making. Moreover, the development of Non-Fungible Tokens (NFTs) has attracted many new investors, creating unique trading opportunities within the cryptocurrency space.

Looking Ahead: The Future of Cryptocurrency Trading

As we move forward, the future of cryptocurrency trading appears promising yet uncertain. Experts predict that if regulatory frameworks are established effectively, institutional adoption of cryptocurrencies will continue to rise, providing stability and legitimacy to the market. This could pave the way for traditional financial institutions to offer cryptocurrency trading services, further bridging the gap between traditional finance and digital assets.

For investors, understanding the dynamics of cryptocurrency trading remains paramount. Keeping abreast of technological advancements, regulatory changes, and market trends will be essential for navigating this ever-evolving landscape. As the market matures, informed trading practices will become increasingly vital, ensuring that participants can adapt to upcoming challenges and opportunities.