Introduction

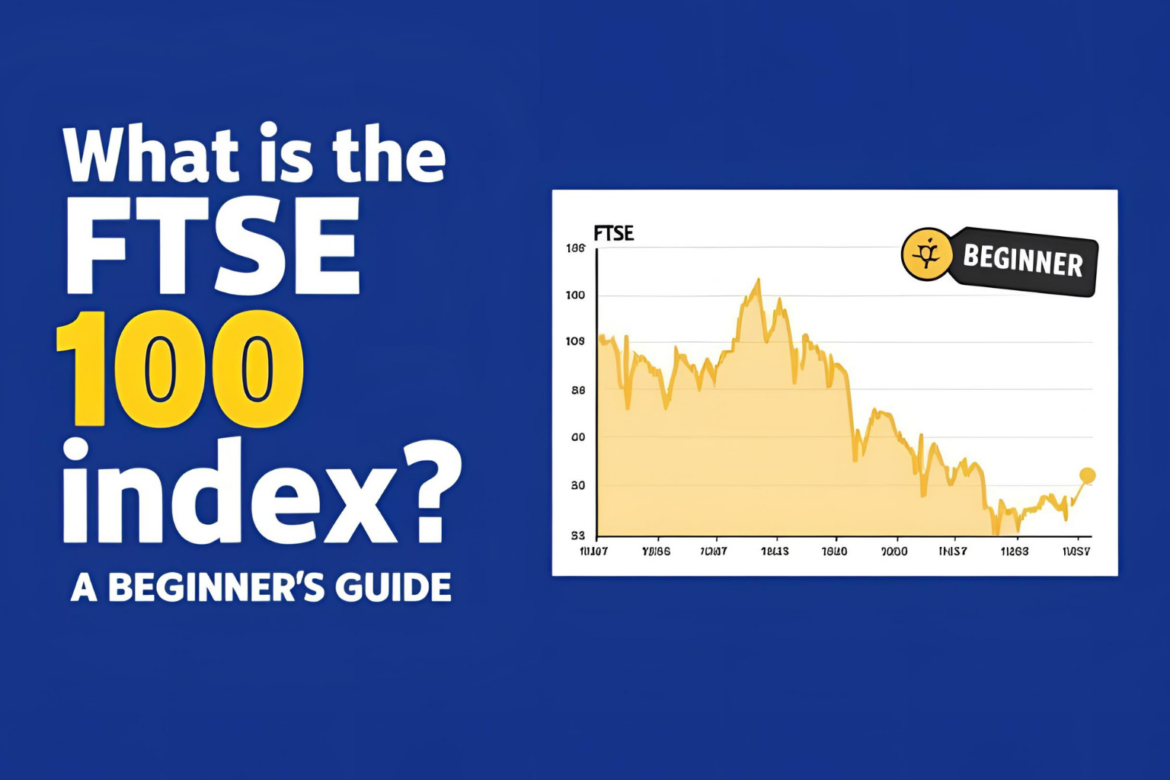

The FTSE 100 Index, commonly referred to as the ‘Footsie’, is a crucial financial benchmark that represents the largest 100 companies listed on the London Stock Exchange (LSE) by market capitalisation. As a reflection of the UK’s economic health, the FTSE 100 serves not only as a barometer for investors but also provides insights into broader global economic trends. In light of recent economic shifts, understanding the dynamics of the FTSE 100 is more important than ever for investors and analysts alike.

Current Performance and Trends

As of mid-October 2023, the FTSE 100 Index has been navigating through a period of volatility, influenced by various factors including inflation rates, interest rate hikes by the Bank of England, and geopolitical events. The index has seen fluctuations due to ongoing concerns about energy prices and their effect on company earnings, particularly for sectors heavily reliant on energy such as utilities and transportation.

Recent reports indicate that the FTSE 100 lifted by approximately 2% following a positive earnings report from major financial institutions, suggesting resilience in the banking sector. Furthermore, the technology sector, represented on the index by companies such as AstraZeneca and Unilever, has shown strong performance amidst a surge in demand for digital services and healthcare innovations.

Impact of External Factors

In recent months, the UK economy has faced headwinds from international economic pressures, including supply chain disruptions and inflationary concerns stemming from ongoing conflicts and the COVID-19 pandemic recovery. The Bank of England’s monetary policy adjustments have also played a significant role in influencing market activities. Analysts speculate that inflation control measures may lead to stabilisation in the market, potentially boosting the FTSE 100 in the subsequent quarters.

Conclusion

The FTSE 100 Index remains a critical component of the UK’s financial landscape, reflecting both local and global economic factors. As we move forward into 2024, investors will likely keep a close watch on policy changes and market dynamics that could affect its trajectory. With the current fluctuations, taking a calculated and informed approach is essential for those looking to invest in this vital index. Staying informed will empower investors to navigate these uncertain waters effectively.