Introduction

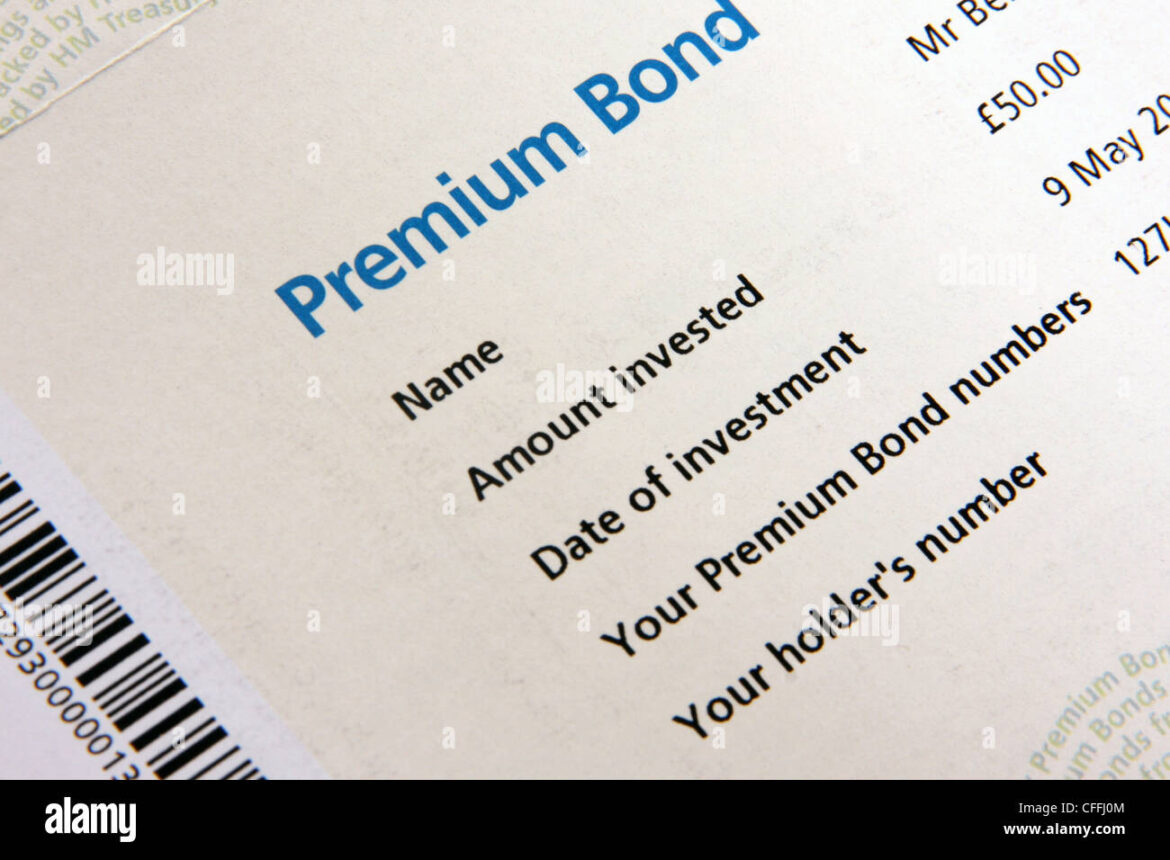

Premium bonds have become a prominent savings option in the United Kingdom, offering residents a unique way to invest their money while also having the chance to win monthly prizes. Launched in 1956 by National Savings and Investments (NS&I), this scheme allows savers to purchase bonds that enter them into a prize draw, making it a popular choice for risk-averse individuals looking to grow their wealth safely.

The Mechanism of Premium Bonds

When an individual purchases premium bonds, their money is pooled, and each £1 bond has a chance to win prizes ranging from £25 to £1 million in the monthly draws. Instead of earning interest, the returns come in the form of these prize winnings. As of 2023, the odds of winning a prize per £1 bond are approximately 24,000 to 1, with a total prize fund worth over £1 billion annually.

One of the key attractions of premium bonds is that the investment is entirely interest-free; however, it is also free from capital gains tax or income tax. The minimum investment is £25, while the maximum holding limit is set at £50,000. This flexibility allows individuals from different financial backgrounds to participate in the scheme.

Recent Developments and Trends

Recent data from NS&I indicates a growing interest in premium bonds, particularly during challenging economic times when traditional savings accounts offer low interest rates. As of October 2023, over 23 million bondholders have invested in the scheme, holding more than 100 billion bonds collectively. This reflects a significant trend towards seeking inflation-proof savings vehicles amidst the rising cost of living in the UK.

In response to rising inflation rates, NS&I has also expanded marketing efforts to educate potential savers about the benefits and workings of premium bonds. This has resulted in increased inquiries and investments, with many individuals viewing premium bonds as a secure method of preserving their capital while taking advantage of the potential for prize winnings.

Conclusion

Premium bonds remain a uniquely appealing savings method in the UK, particularly for individuals who prefer a non-traditional approach to investing. The absence of interest combined with the allure of potential winnings provides a distinctive appeal. As economic conditions evolve, more UK residents may consider premium bonds for their savings strategy, especially as it offers both security and excitement in the realm of personal finance. With the growing interest, it will be intriguing to observe how this popular savings option continues to evolve in the upcoming years.