Introduction

PayPal Holdings Inc. has been a key player in the digital payment landscape since its inception. As technology evolves and online shopping surges, the performance of its stock (NASDAQ: PYPL) becomes increasingly significant for investors. Understanding the current trends surrounding PayPal stock is crucial not only for potential investors but also for existing shareholders looking to navigate the volatile market environment.

Recent Performance and Market Trends

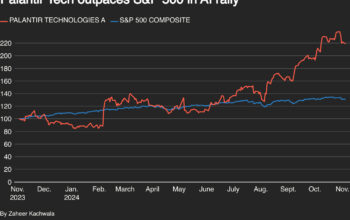

Over the past year, PayPal’s stock has experienced considerable fluctuations. At the beginning of 2023, PYPL shares were trading around $76, rising steadily to $99 by July before facing a drop to approximately $75 in October, following broader market trends and investor sentiment shifts regarding tech stocks. Analysts attribute this volatility to multiple factors, including increased competition in the fintech space, fluctuating consumer spending, and macroeconomic challenges such as inflation and rising interest rates.

Quarterly Earnings Report

In its recent earnings call for Q3 2023, PayPal reported revenues of $6.80 billion, exceeding analysts’ expectations. A net income of $950 million was also a positive indicator, suggesting effective cost management strategies. The company’s active user base grew to 429 million, attracting attention from investors and stakeholders alike. However, guidance for Q4 was conservative, reflecting anticipated seasonal factors and ongoing economic pressures.

Future Outlook and Implications

The future of PayPal stock appears mixed, with analysts offering varied perspectives. On one side, some experts view PayPal’s efforts in expanding its services—such as the recent integration of cryptocurrency transactions and advancements in mobile payment options—as potential growth drivers. Conversely, there are concerns regarding increasing competition from platforms like Square and traditional banks that are enhancing their digital offerings.

Investor Sentiment

Currently, sentiment among investors remains cautiously optimistic. With the stock’s P/E ratio of 22.4 falling below the industry average, some investors see it as undervalued, prompting interest in long-term investment. Furthermore, PayPal has announced share buybacks to bolster stock value, which is generally considered a positive move by shareholders.

Conclusion

In conclusion, PayPal’s stock performance continues to be a focal point in the technology and finance sectors. While the company has reported positive earnings and growth in user engagement, broader economic factors and competitive pressures will play a significant role in its future trajectory. Investors should stay informed of both the financial metrics and external market conditions as they approach decisions regarding PayPal stock. Understanding these developments will be crucial for making informed choices in an ever-evolving marketplace.