Introduction

The Scottish Budget Income Tax changes for 2023 have garnered considerable attention as they reflect the government’s fiscal strategy and its implications for taxpayers across Scotland. With the cost of living continuing to affect households, the decisions made in this budget are significant for many. These changes are expected to impact disposable incomes, public services funding, and overall economic growth in Scotland.

Details of the Changes

The 2023 Scottish Budget, presented by the Finance Secretary, has introduced several key modifications to the income tax system. One of the most notable changes is the increase in the higher rate tax threshold, which has been raised from £43,662 to £47,000. This adjustment aims to alleviate some of the financial pressure households are experiencing amid rising living costs.

Furthermore, the basic rate of income tax remains at 20%, while the higher rate is increased to 40% for those earning over the new threshold. The additional rate will still apply to those earning over £125,140, retaining the rate at 46%, which remains higher than the equivalent rates in England.

Impact on Taxpayers

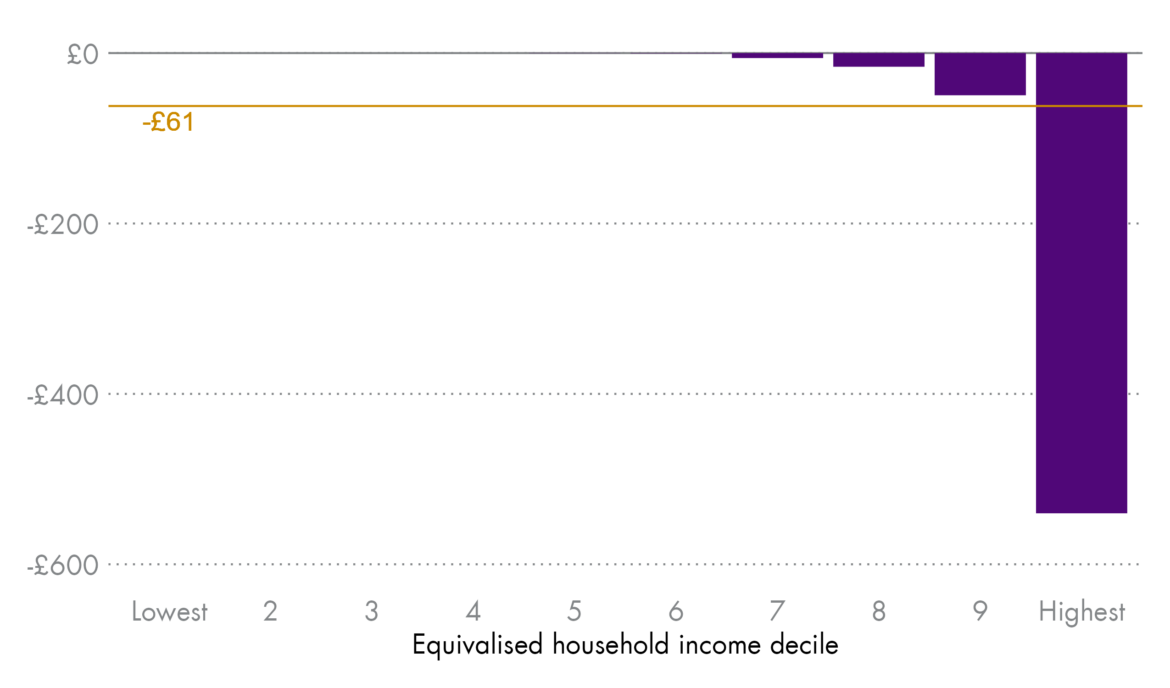

The adjustments are expected to benefit those in the middle-income bracket, providing relief to many households while allowing the Scottish government to maintain vital funding for public services. These changes aim to support economic sustainability in Scotland, particularly in the context of challenges arising from inflation and other economic pressures.

Opposition parties have voiced concerns regarding the overall structure of the tax system, advocating for a fairer distribution of tax burdens. They argue that while these changes provide some relief, they do not thoroughly address the needs of lower-income families who may still struggle under current economic conditions.

Conclusion

As the new income tax framework rolls out, it is crucial for taxpayers and businesses in Scotland to understand these changes and how they may affect their financial situation. While the adjustments aim to provide necessary support for middle-income earners, the long-term effects on public service funding and economic stability will remain to be seen. Observers will be watching closely to evaluate the effectiveness of these measures and the potential need for further reforms in future budgets. Ultimately, the Scottish Budget Income Tax changes reflect a cautious yet responsive approach to the pressing economic realities faced by many citizens today.