Introduction

The trading relationship between Bitcoin (BTC) and the US dollar (USD) is a significant aspect of the cryptocurrency market, influencing investor behaviour and market dynamics. As Bitcoin’s popularity continues to grow, understanding its fluctuations against the USD is crucial for traders, investors, and financial analysts alike. The BTC/USD pair serves as the most popular trading pair in the crypto world, often reflecting broader economic trends and sentiments.

Recent Market Trends

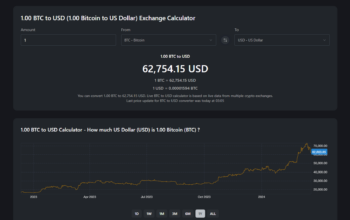

In recent months, the BTC to USD exchange rate has experienced notable volatility. As of late October 2023, Bitcoin is trading around $40,000, marking a resurgence from the lows witnessed earlier in the year. The recent spike in value can be attributed to a variety of factors, including increased institutional adoption, the launch of Bitcoin ETF products, and a more stable regulatory environment in significant markets.

Additionally, the correlation between Bitcoin and traditional stock markets has become more evident, as macroeconomic trends impact both asset classes. The ongoing inflation concerns and shifts in monetary policy in the US have further affected investor sentiment. The recent performance of BTC reflects an underlying demand for alternative assets in a potentially inflationary environment.

Key Factors Influencing BTC/USD

Several key factors contribute to the fluctuations in the BTC to USD market:

- Regulations: Positive regulatory developments in countries such as the United States and Canada play a crucial role in bolstering investor confidence.

- Institutional Investment: Increased buying by institutional players like hedge funds and corporations signals strong belief in Bitcoin’s long-term value.

- Technological Advances: Improvements in blockchain technology and the implementation of scalability solutions can enhance Bitcoin’s usability and attractiveness.

- Market Sentiment: The overall market sentiment, driven by news, social media activity, and economic indicators, can cause rapid price movements.

Conclusion: What Lies Ahead?

As we look towards the future, it is crucial for investors to stay informed about the ongoing trends affecting the BTC to USD exchange. Predictions for the cryptocurrency market remain mixed; while some analysts anticipate further growth in Bitcoin’s value, others caution against potential corrections. The significance of macroeconomic conditions, technological advancements, and regulatory developments will likely continue to shape the trajectory of Bitcoin against the US dollar.

Understanding the intricacies involved in the BTC/USD exchange will empower both new and seasoned investors to make informed decisions in an ever-evolving market. Staying up-to-date with market analysis and forecasts can provide valuable insights for navigating the future of cryptocurrency investments.