Introduction to Lifetime ISA

The Lifetime Individual Savings Account (ISA) has emerged as a significant vehicle for saving towards home ownership and retirement. Launched in 2017, the Lifetime ISA allows individuals under the age of 40 to put away funds that can benefit from government bonuses. With rising housing costs and retirement concerns, understanding the implications of the Lifetime ISA is crucial for many UK citizens.

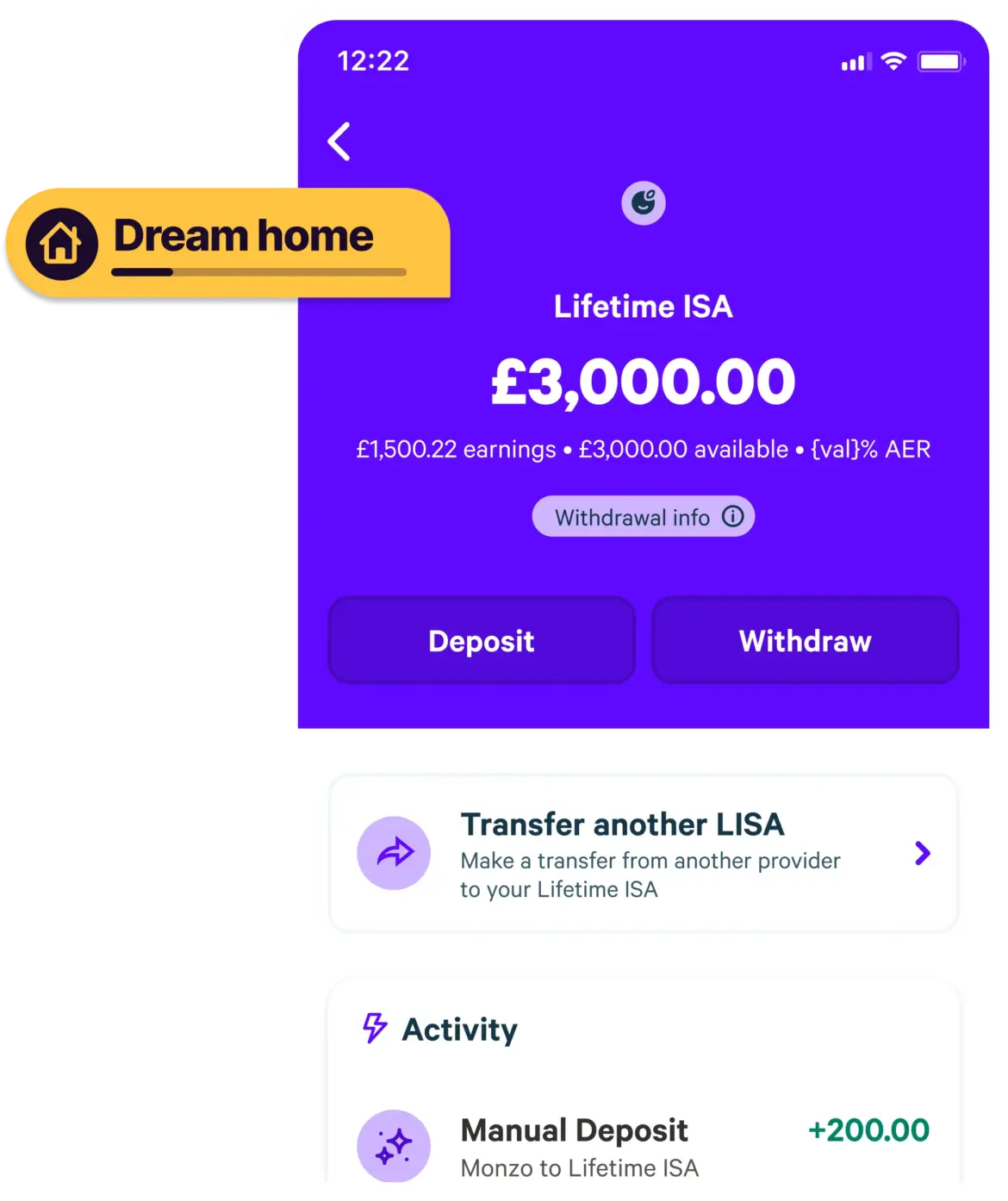

What is a Lifetime ISA?

A Lifetime ISA is a special type of savings account designed specifically for those saving for their first home or aiming for retirement. Individuals can save up to £4,000 each tax year, and the government lends a helping hand by providing a 25% bonus on contributions up to a maximum of £1,000 annually. The funds can be withdrawn tax-free for the purchase of a first home worth up to £450,000, or at age 60 if the funds are meant for retirement.

Key Features and Benefits

One of the primary advantages of the Lifetime ISA is its tax-efficient nature. The money saved allows for investments in a variety of assets, therefore offering the potential for financial growth. Furthermore, the 25% government bonus incentivises long-term saving, making it an appealing option for many under 40 who can take advantage of compound interest over time.

Recent Developments

As of 2023, the Lifetime ISA continues to adapt to the changing financial landscape. New regulations have streamlined the process, making it easier for individuals to open accounts, and several financial institutions are now offering Lifetime ISAs with competitive interest rates. Moreover, awareness campaigns have heightened, leading to increased participation among eligible young savers.

Conclusions and Future Outlook

The Lifetime ISA presents a promising solution for young savers aiming to secure their financial futures amidst economic volatility. Analysts predict that as housing markets remain competitive, more individuals will turn to Lifetime ISAs to aid in their aims of home ownership and retirement savings. For anyone considering the prospects of acquiring a property or planning for their retirement, exploring the benefits of a Lifetime ISA is highly recommended.