Introduction to mbanq

In an age where digital transformation is reshaping industries, the banking sector is no exception. mbanq stands at the forefront of this evolution, providing a robust Banking as a Service (BaaS) platform that allows businesses to offer banking solutions seamlessly. This development is crucial as it enables non-banking organisations to enter the financial services space, catering to a growing demand for innovative and flexible banking options.

What is mbanq?

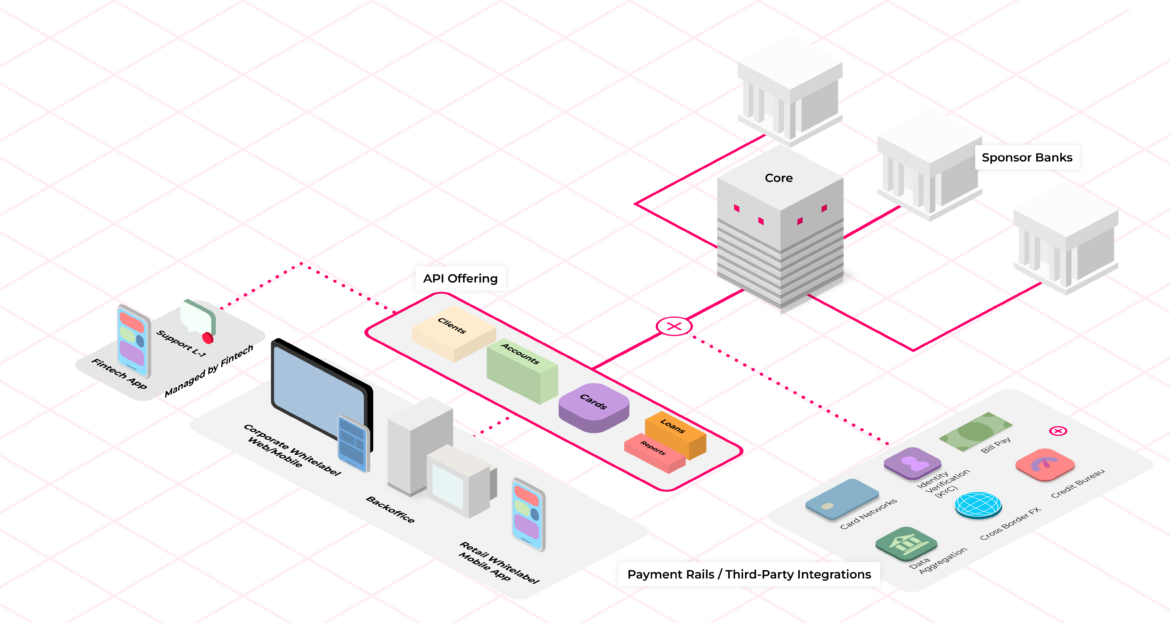

Founded in 2017, mbanq offers a comprehensive set of financial services that includes payment processing, compliance assistance, and bank account management among others. By leveraging advanced technology, mbanq empowers fintechs, retailers, and traditional businesses alike to create tailored banking experiences without the need for extensive investment in infrastructure. The BaaS model adopted by mbanq allows these entities to focus on customer experience while mbanq handles the backend services.

Recent Developments and Partnerships

In recent months, mbanq has seen significant growth and expansion. A notable partnership was formed with several fintech startups, allowing them to integrate mbanq’s services into their platforms. Not only does this showcase mbanq’s versatility, but it also highlights the increasing reliance on third-party service providers to manage banking functionalities. Furthermore, mbanq has updated its platform to enhance security measures, as cybersecurity remains a pivotal concern in financial technology.

Market Impact and Future Outlook

The rise of mbanq is indicative of the broader trends within the financial services industry, particularly the shift towards digital banking solutions. As consumers increasingly favour the convenience of online services, the demand for integrated financial solutions continues to soar. Analysts predict that mbanq will play a crucial role in this landscape, enabling further innovation in banking services. As the platform scales, it is expected to attract more partners and expand its service offerings, potentially reaching global markets.

Conclusion

mbanq is evolving the banking landscape by enabling new players to offer financial services easily and reliably. Its impact on the fintech ecosystem is significant, paving the way for traditional companies to enhance their service offerings while also creating opportunities for startups. As the market continues to evolve in the wake of technological advances, mbanq is well-positioned to remain a key player in the Banking as a Service arena, supporting the next generation of banking solutions.