The Importance of Student Finance

Student finance plays a crucial role in making higher education accessible to UK residents. With the rising costs of tuition and living expenses, understanding the intricacies of student finance is essential for prospective and current students aiming to succeed academically without incurring crippling debt.

Current Landscape of Student Finance

As of the 2023 academic year, tuition fees for undergraduate courses in England have remained capped at £9,250 per year for full-time students. However, many institutions are exploring new ways to enhance their offerings, which may include additional costs for certain courses, particularly in fields requiring extensive materials.

Students have the opportunity to apply for a Tuition Fee Loan, which covers the full cost of their tuition, and a Maintenance Loan to assist with living costs. According to the Student Loans Company, the average Maintenance Loan stands at approximately £5,000, though this figure can vary based on household income and study location.

Grants and Scholarships Available

In addition to loans, various grants and scholarships are accessible for students from low-income backgrounds, disabled students, and those studying specific subjects. Programs such as the Care Leaver Bursary aim to provide additional financial support for students who have spent time in care, reducing financial barriers to education.

Budgeting Tips for Students

Proper budgeting is crucial for students managing limited finances. Students are advised to create a monthly budget that accounts for tuition payments, rent, groceries, transport, and leisure activities. Tools such as budgeting apps or spreadsheets can help track spending and income effectively.

Future Trends in Student Finance

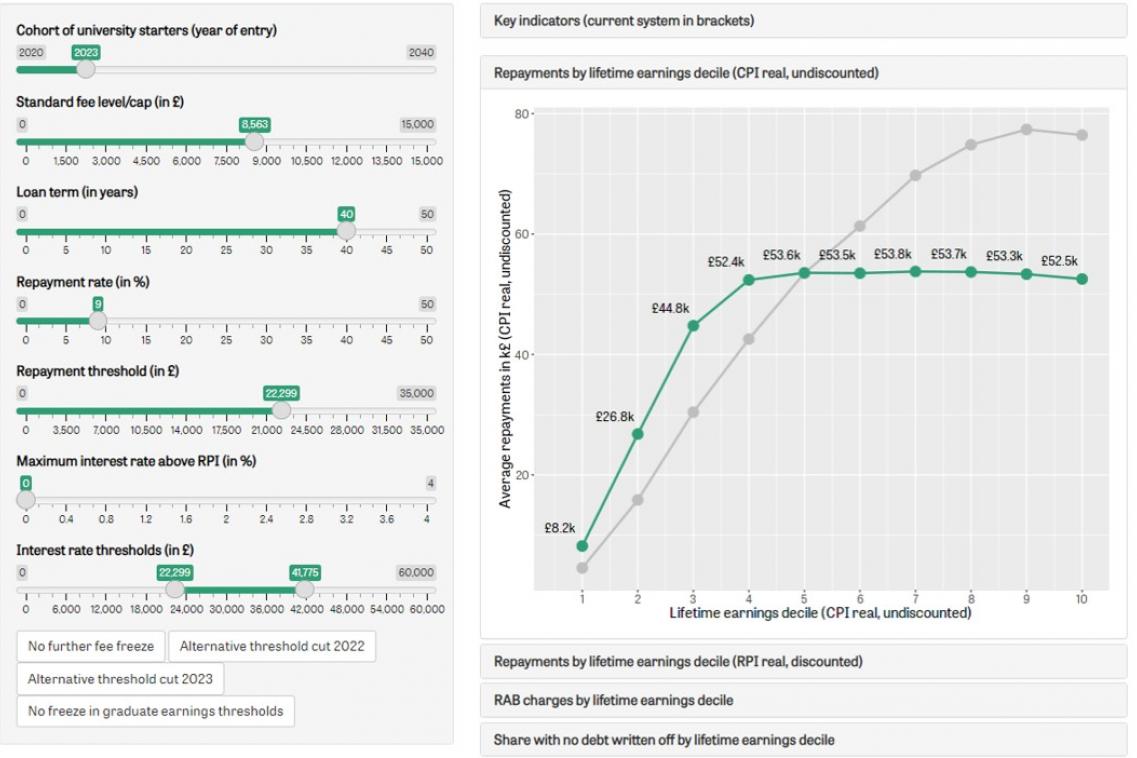

As the government continues to review student finance policies, changes may emerge in the next few years. Discussions around tuition fee reforms and adjustments to repayment thresholds indicate possible shifts in how student finance operates in the UK. Stakeholders, including students, higher education institutions, and policymakers, must remain engaged in these conversations to ensure that future frameworks are equitable and sustainable.

Conclusion

In conclusion, understanding student finance is vital for anyone considering higher education in the UK. With various options available for funding and support, students can navigate their academic journeys more effectively. Staying informed about changes in student finance policies and managing finances wisely can significantly impact a student’s overall experience and future financial stability.