Understanding Inflation and Its Importance

Inflation is a critical aspect of modern economics, affecting everything from consumer prices to government policy decisions. As nations recover from the economic impacts of the COVID-19 pandemic, concerns about future inflation rates have become increasingly pertinent. This article explores predictions and factors influencing inflation in the year 2026, providing valuable insights for economists, policymakers, and consumers alike.

Current Economic Landscape

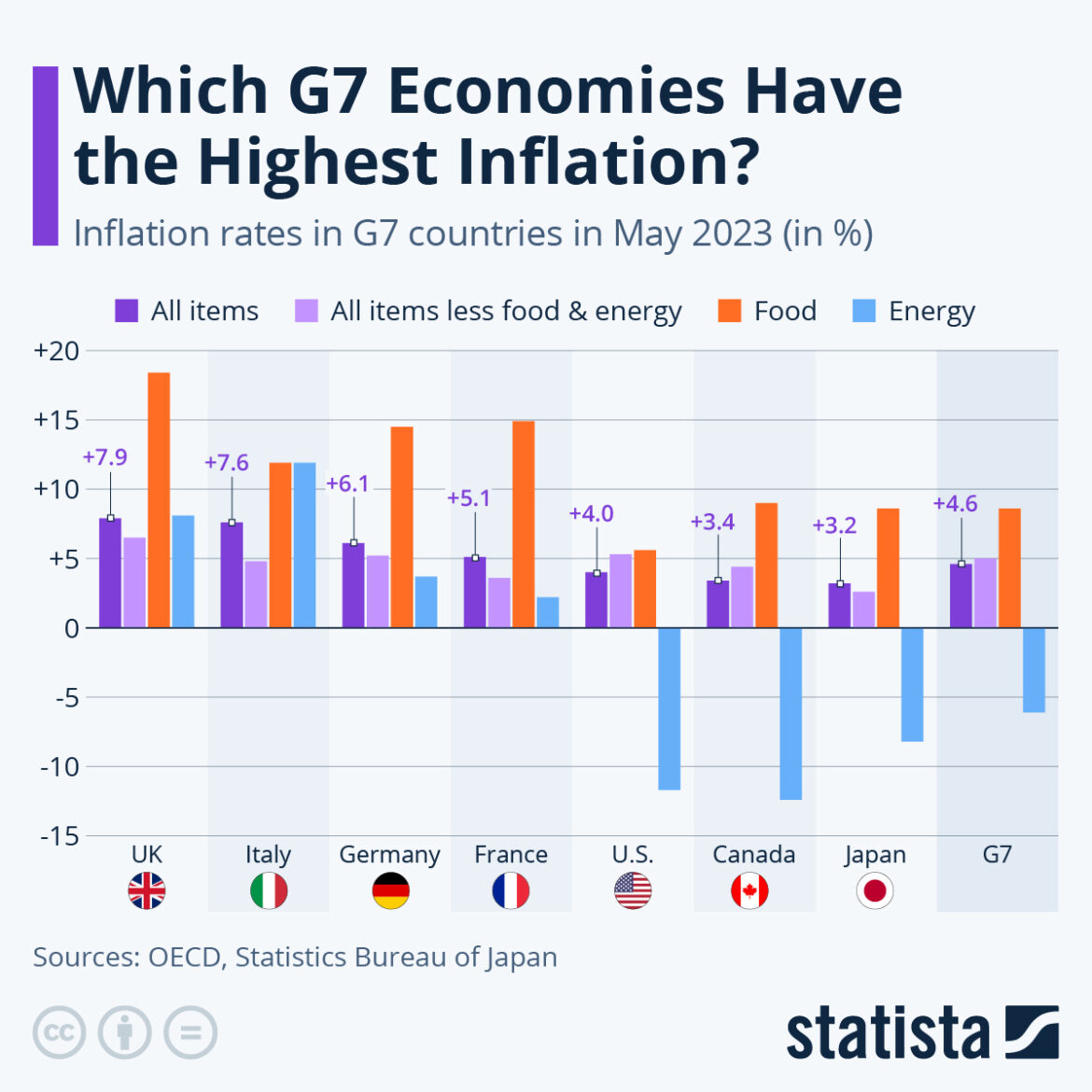

As of late 2023, inflation rates in various countries have shown signs of stabilisation after reaching unprecedented levels in previous years, primarily due to supply chain disruptions and increased demand post-pandemic. In the UK, for instance, inflation peaked at around 10% in October 2022, significantly impacting purchasing power and livelihoods. The Bank of England has implemented a series of interest rate hikes to combat inflationary pressures, and the latest reports indicate a gradual decline to around 4% by late 2023.

Predictions for 2026

Looking ahead to 2026, economists predict that inflation rates will continue to normalise but will not return to the historically low levels seen prior to the pandemic. A consensus forecast suggests that inflation could hover between 2% and 3% in the UK by 2026, bolstered by factors such as increased global demand, ongoing supply chain adjustments, and potential wage pressures as employment markets tighten. Additionally, climate change and geopolitical tensions may further influence commodity prices, adding to inflationary pressures.

Key Influencing Factors

Several main factors are expected to shape the inflation landscape in 2026, including:

- Monetary Policy: Central banks may continue to adjust interest rates in response to evolving inflation rates, affecting borrowing costs and economic activity.

- Supply Chain Resilience: Improvements in supply chains are expected to help stabilise prices, although certain sectors may still experience volatility.

- Energy Prices: Fluctuations in oil and gas prices due to geopolitical events or changes in supply-demand dynamics could significantly impact inflation.

- Government Stimulus: Ongoing governmental financial support could drive demand, influencing prices as economies continue to recover.

Conclusion

As we approach 2026, the outlook for inflation remains a balancing act of recovery, policy intervention, and external factors. Understanding these dynamics will be crucial for individuals and businesses as they plan for the future. While the current trend suggests a return to ‘normal’ inflation rates, unexpected global events could still lead to fluctuations. Stakeholders should remain vigilant to adapt to these economic conditions, ensuring they are well-prepared to navigate the challenges and opportunities that lie ahead.