Introduction

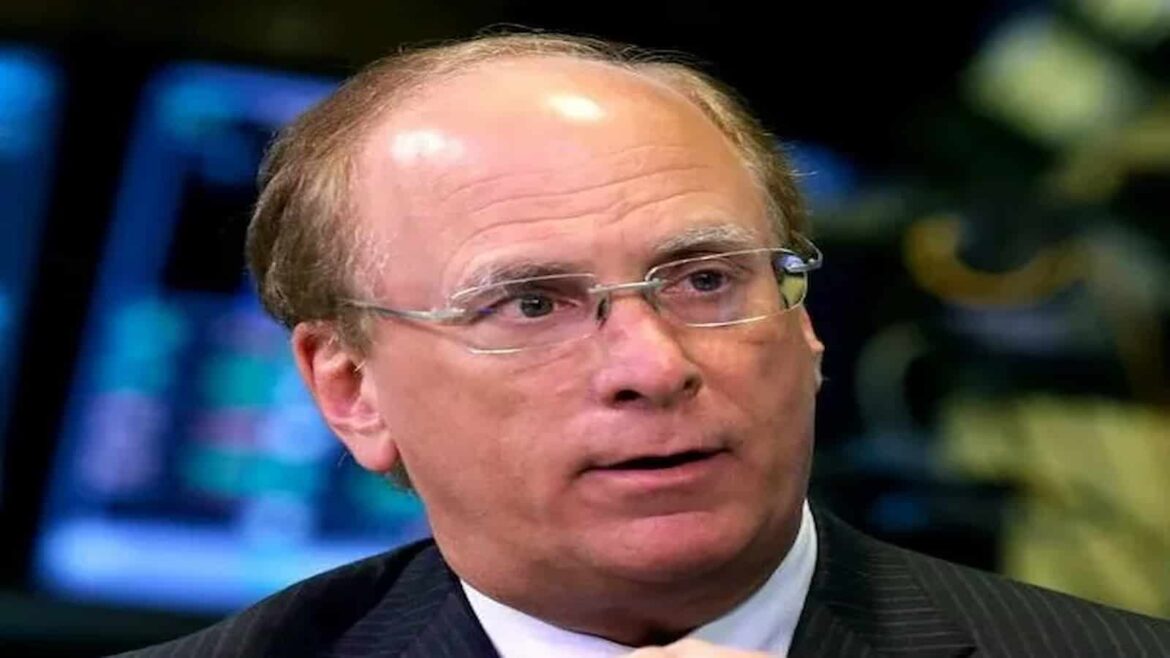

Larry Fink, the CEO of BlackRock, is a prominent figure in the world of finance, overseeing the largest asset management firm globally. His insights and strategies influence not just the stock market but also corporate governance and sustainable investing. As the financial landscape evolves, understanding Fink’s role helps investors, corporations, and policymakers navigate the intricacies of global finance.

The Rise of Larry Fink

Fink co-founded BlackRock in 1988, and under his leadership, it has grown to manage over $9 trillion in assets. Fink’s approach to investment focuses on risk management, which was largely informed by his experiences in the 1980s when he saw the significant impact that risk assessment could have on returns.

Known for his outspoken opinions, Fink has often highlighted the importance of environmental, social, and governance (ESG) factors in investment decisions. In his annual letters to CEOs, he calls for companies to operate sustainably and address climate change, influencing many firms to adapt to these expectations.

Recent Developments

In 2023, Fink remained at the forefront of economic discussions, particularly regarding inflation and interest rates. With the Federal Reserve’s efforts to control inflation, Fink urged investors to prepare for a more volatile market. He also addressed the geopolitical tensions affecting supply chains and energy prices, acknowledging that these factors would play a critical role in shaping investment strategies over the coming years.

This year, BlackRock has expanded its offerings in sustainable investing as the demand for ESG-compliant funds continues to grow. Fink’s leadership in this area positions BlackRock as a key player in the transition towards more responsible investment practices.

Conclusion

Larry Fink’s influence on the financial sector is profound, with implications that extend beyond traditional investing. His emphasis on sustainability and corporate responsibility has not only shaped BlackRock’s investment philosophy but has also set a precedent for other firms in the industry. As markets evolve, investors and corporations alike must consider Fink’s perspectives on risk and sustainability to remain competitive.

Looking forward, Fink is likely to continue advocating for integrating ESG principles into mainstream investing, anticipating shifts in investor sentiment and regulatory changes. His vision will be pivotal for guiding the financial landscape towards a more sustainable future.