Introduction

Capital plays a crucial role in economics as one of the fundamental factors of production. It enables businesses to invest, expand, and innovate, which ultimately fuels economic growth. The relevance of capital has been underscored in recent months as economies strive for recovery post-pandemic, making this a timely topic for discussion.

The Types of Capital

Capital refers to the financial resources that are used by businesses to fund their operations and growth. It can be classified into various types, including:

- Physical Capital: This includes machinery, buildings, and technology used in production.

- Human Capital: The skills, knowledge, and experience possessed by individuals that contribute to economic productivity.

- Financial Capital: The funds needed to invest in business activities, which can come from loans, equity, or retained earnings.

Current Trends Affecting Capital

Currently, several trends are influencing the landscape of capital:

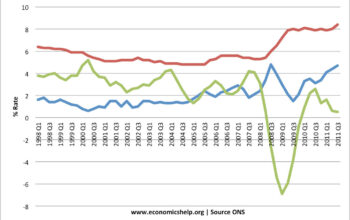

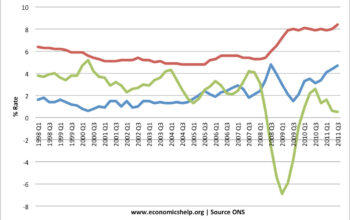

- Interest Rates: Central banks, particularly in the UK and US, have recently altered interest rates in response to economic conditions, affecting borrowing costs for businesses.

- Investment in Technology: Businesses are increasingly directing capital towards digital transformation and automation to enhance efficiency.

- Venture Capital Growth: Start-ups are attracting significant venture capital investments, with increased interest from investors in innovative sectors such as green technology and artificial intelligence.

Conclusion

In summarising, capital remains a vital element of economic stability and growth. As economies navigate through recovery phases, understanding its dynamics can provide valuable insights for businesses and stakeholders alike. The future forecasts a continued emphasis on innovation and sustainability in capital deployment, which could further reshape economic landscapes. For readers, keeping an eye on capital trends is essential for making informed investment and business decisions in this rapidly changing environment.