Introduction

Klarna, a Swedish payment solutions company, has been instrumental in transforming the landscape of online shopping since its inception in 2005. With a mission to make shopping smoother and more convenient for consumers, Klarna has gained significant traction globally, particularly during the surge of e-commerce triggered by the COVID-19 pandemic. This article explores Klarna’s services, its influence on shopping habits, and what the future may hold for this innovative fintech.

The Rise of Klarna

Klarna’s popularity can be attributed to its unique ‘buy now, pay later’ (BNPL) model, which allows consumers to purchase items and defer payments. This model has provided a financial alternative to traditional credit cards, appealing particularly to younger generations who prefer flexible payment methods. As of 2023, Klarna has over 100 million users worldwide and partners with over 250,000 retailers, making it one of the largest BNPL providers globally.

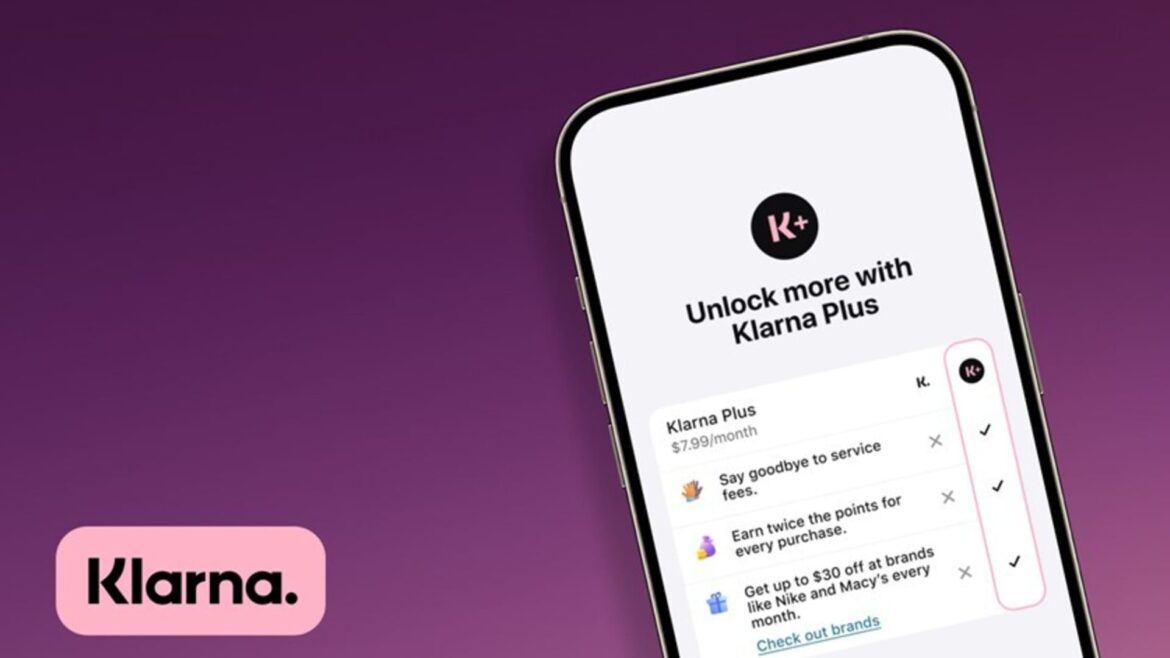

Key Features of Klarna

Klarna offers several features designed to enhance the shopping experience. Consumers can choose to pay immediately, pay in 30 days, or split purchases into manageable instalments, thus allowing them to manage their budgets effectively. Furthermore, Klarna’s app provides product recommendations, price tracking, and alerts for discounts, making it a comprehensive shopping companion. In addition, the integration of Klarna into retailer websites streamlines the checkout process, reducing cart abandonment rates.

Impact on Retailers and Consumers

Retailers have reported increased sales and higher average order values since integrating Klarna into their payment options. By offering consumers the ability to buy now and pay later, retailers can attract more customers who might have otherwise abandoned their carts due to upfront payment requirements. For consumers, Klarna has become a tool for responsible shopping, allowing them to purchase items while keeping better track of their expenses. However, it is essential to acknowledge the potential risks, as BNPL services can lead some users into debt if not managed diligently.

Conclusion

Klarna’s innovative approach to payments has undoubtedly reshaped the way we shop online, promoting flexibility and convenience in an ever-evolving digital marketplace. As e-commerce continues to grow, Klarna’s role will likely expand, pushing the boundaries of traditional payment systems further. For consumers and retailers alike, understanding Klarna’s service offerings and implications can aid in making informed financial decisions that benefit their respective shopping experiences. The future of shopping may be revolutionised by such fintech innovations, creating opportunities for engagement and efficiency in transactions.