Introduction

The US inflation rate has garnered significant attention in recent months as consumers and policymakers grapple with rising prices and their implications. Inflation affects everything from everyday goods and services to investments and economic stability. Understanding the current trends and factors influencing the inflation rate is crucial for making informed decisions in both personal and financial realms.

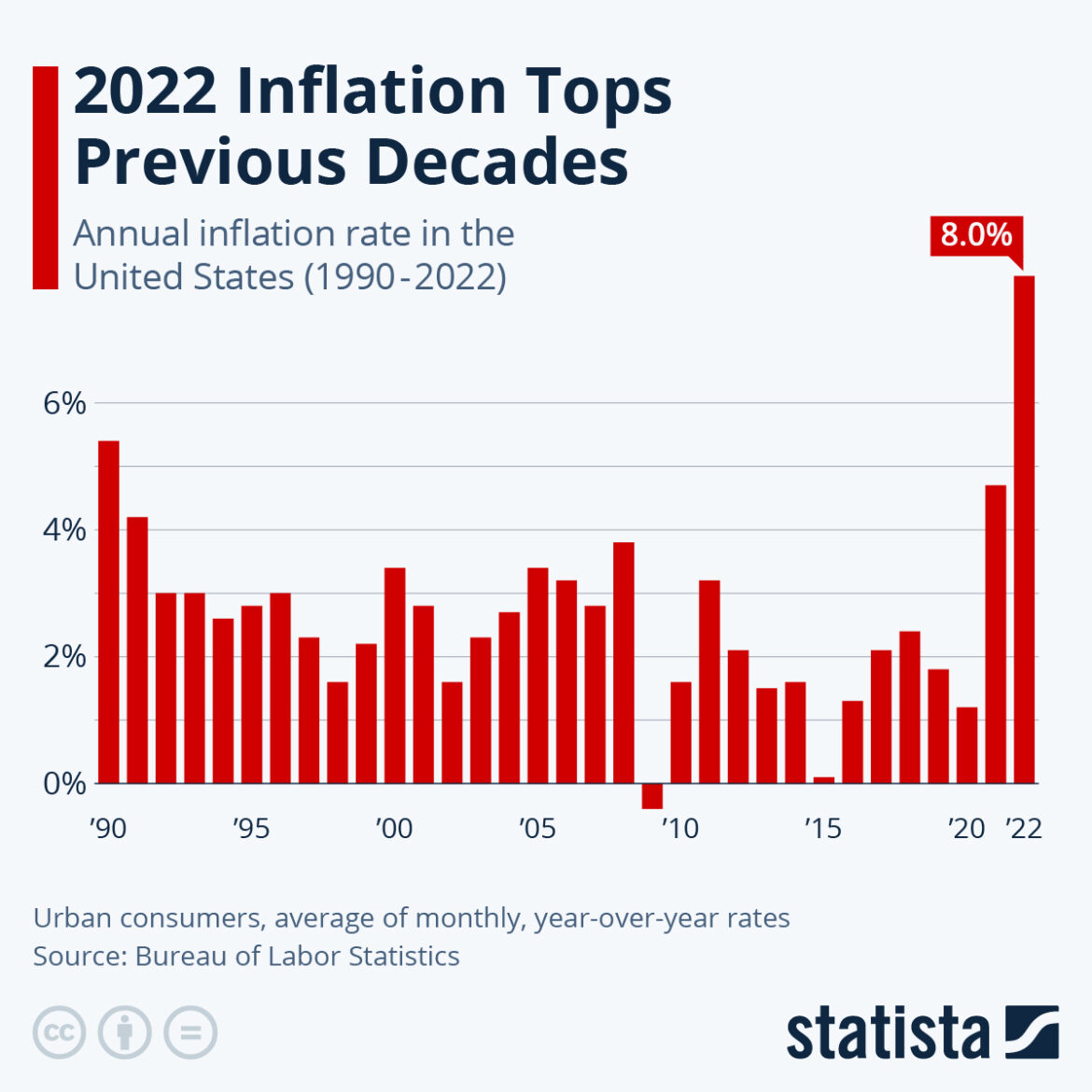

Current Inflation Rates

As of September 2023, the inflation rate in the United States stands at approximately 3.7%, a slight increase from the previous month, according to the Bureau of Labor Statistics (BLS). This figure remains notably lower than the peak of 9.1% witnessed in June 2022, triggered by a combination of pandemic-related supply chain disruptions, rising energy prices, and geopolitical conflicts.

Underlying Factors Contributing to Inflation

Several factors continue to play a role in shaping the inflation landscape in the US. Firstly, the Federal Reserve’s monetary policy responses, including interest rate hikes aimed at curtailing inflation, have had mixed results. The Federal Open Market Committee (FOMC) has increased rates multiple times over the past year, with the latest rate sitting between 5.25% and 5.50%.

Additionally, persistent supply chain issues, particularly in sectors such as housing and food, have contributed to price increases. The impact of these disruptions is still felt as businesses struggle to maintain inventory levels while meeting growing consumer demand.

Consumer Impact

For consumers, the rising inflation rate translates into higher costs of living. Basic necessities, including groceries and housing, have become increasingly expensive, affecting household budgets nationwide. The Federal Reserve’s goal is to achieve a 2% inflation rate in the long term, but achieving this target without causing a recession is a balancing act that remains a topic of debate among economists.

Conclusion

As the US inflation rate fluctuates, it is essential for individuals and businesses to stay informed about the broader economic trends that will influence their financial decisions. Looking ahead, policymakers face the challenge of managing inflation while fostering economic growth. The ongoing monitoring of inflationary pressures and adjustments in monetary policy will be crucial to navigate the complexities of the current economic environment.