Introduction

The UK inflation rate has become a pivotal topic of discussion as it plays a crucial role in shaping the nation’s economic landscape. As of September 2023, inflation remains elevated, significantly impacting consumer prices, wages, and the overall economic environment. Understanding the inflation rate is essential for businesses, policymakers, and consumers as they navigate financial decisions in an ever-changing economic climate.

Current Inflation Rate Overview

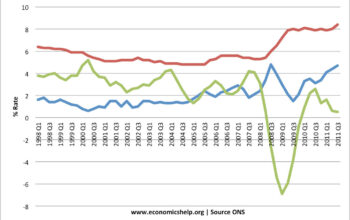

According to the Office for National Statistics (ONS), the UK inflation rate, measured by the Consumer Prices Index (CPI), was recorded at 6.7% in August 2023. This marks a slight decrease from previous months; however, it continues to pose challenges for households coping with rising living costs. Notably, significant contributors to inflation include energy prices, food costs, and transportation expenses, which have seen various fluctuations due to geopolitical factors and supply chain disruptions.

Recent Economic Developments

The Bank of England (BoE) has responded to these inflation trends with strategic monetary policies, including interest rate adjustments. In response to inflationary pressures, the BoE increased interest rates to 5.25% in September 2023, aiming to curb spending and stabilise prices. Industry experts suggest that while interest rate hikes may gradually alleviate inflation, they could also lead to slower economic growth and increased borrowing costs for consumers and businesses alike.

Forecasts and Future Implications

The future trajectory of the UK inflation rate remains uncertain. Analysts predict inflation may continue to decline in the forthcoming months, potentially reaching the BoE’s target of around 2% by mid-2024 if current trends persist. However, external factors such as energy supply stability and global economic conditions could influence this outlook. In light of recent developments, businesses are advised to prepare for ongoing fluctuations in prices, adjusting strategies accordingly to navigate potential financial constraints.

Conclusion

The UK inflation rate serves as a vital indicator of economic health, representing the purchasing power of households and the overall stability of the market. As we look towards the future, monitoring inflation trends will be essential for individuals and businesses alike. Ultimately, staying informed about the inflation rate and its implications can help readers make better financial decisions as the economic landscape continues to evolve.